THE QUADRILLION DOLLAR SHADOW

Inside the Empire of Financial Derivatives

Rain streaks across the tinted windows of a Manhattan high-rise, distorting the city lights fifty floors below. Inside, a trader’s finger hovers over a keyboard. One keystroke will execute a contract worth more than the GDP of a small nation. This is the derivatives market—where value isn’t tied to anything tangible but to movements of invisible money. One click, and another strand is woven into a web worth one quadrillion dollars—a number so vast it numbs the mind.

WHAT ARE DERIVATIVES?

Imagine at a farmers market, apples sell for $2/pound. A derivative isn’t buying apples—it’s making contracts about them. You might bet prices rise to $3 next month (an option), agree to buy 100 pounds at $2 in December regardless of market price (a future), or swap your apple price risk with someone holding orange price risk (a swap). You never touch apples, yet create financial value from their existence. Multiply this across every commodity, currency, interest rate, and bond worldwide, layer contracts upon contracts—that’s the derivatives market.

THE INVISIBLE EMPIRE

“We’re essentially writing contracts on the future,” explains former trader Julian Meyers, eyes reflecting the blue glow of six monitors. “Imagine bottling fog, labeling it, selling it as solid. That’s derivatives.”

The market makes traditional stock exchanges look like children playing with pocket change. Conservative estimates place its size at $610 trillion, though some believe it exceeds one quadrillion—dwarfing the world’s $100 trillion annual GDP.

Yet unlike iconic stock exchanges, this market operates unseen, in darkened offices through encrypted channels spanning financial hubs from New York to Singapore. Its complexity forms both its armor and allure.

THE ALCHEMISTS

In a glass-walled conference room above Chicago’s financial district, quantitative analysts huddle around equations that might as well be incantations. Their language is peppered with terms like “stochastic volatility” and “Gaussian copulas”—mathematical constructs capturing the essence of financial risk.

“The equations we use aren’t just abstractions—they’re tools of power,” says Dr. Elena Vasquez, a mathematician who transitioned from theoretical physics. “When you create a model that even slightly outpredicts the market, you’ve found a weakness in reality.”

The room has the atmosphere of a war council. Maps are replaced by volatility graphs. Instead of troop movements, they track invisible currents of global capital. The generals wear bespoke suits and speak softly, but their decisions rival any military campaign in stakes.

THE HOUSE OF MIRRORS

Derivatives’ complexity creates a house of mirrors where risk becomes increasingly difficult to locate.

Consider 2008: A Nevada homeowner signs a subprime mortgage. This mortgage is sold to an investment bank, bundled with thousands into a Mortgage-Backed Security (MBS), sliced into tranches based on risk, repackaged into Collateralized Debt Obligations (CDOs), which are themselves divided into tranches. Wall Street then creates “synthetic CDOs”—derivatives that reference these CDOs without owning them. Finally, investors buy Credit Default Swaps—essentially insurance policies against default.

When the homeowner defaults, the impact ripples through this chain, multiplied by thousands of similar mortgages. What began as a $300,000 mortgage default becomes part of a multi-trillion-dollar systemic crisis.

THE COLLAPSE

The aftermath of 2008 resembled a financial crime scene. Lehman Brothers vanished overnight. AIG required a $182 billion bailout. Markets hemorrhaged trillions.

Behind these numbers lay crushing human consequences: 3.8 million Americans lost homes to foreclosure; retirement accounts evaporated—the average 401(k) dropped 31%; public pension funds suffered devastating losses; small municipalities from Norway to Alabama faced bankruptcy after entering complex interest rate swaps they couldn’t understand.

“When derivatives explode, the shrapnel doesn’t just hit Wall Street,” explains consumer advocate Theresa Rodriguez. “It tears through retirement communities, college savings accounts, school and hospital budgets.”

In emergency weekend meetings between officials and executives, the system revealed itself: interconnected to where failure cascades exponentially—a financial nuclear chain reaction.

THE PLAYERS

In a private dining room at an unmarked London restaurant, senior derivatives traders meet monthly for what they jokingly call “risk therapy.”

“The biggest misconception is that we don’t see the dangers,” says one trader requesting anonymity. “We see them better than anyone. We live with them daily. When you work with nuclear material long enough, you stop flinching at radiation warnings.”

These aren’t stereotypical traders—they’re likely PhDs in mathematics. They emerged from 2008 not chastened but emboldened, having witnessed both the system’s vulnerability and importance. They saw governments forced to intervene when derivative failures threatened global collapse.

“There’s immunity in creating something so embedded in financial architecture that its failure becomes unthinkable,” the trader continues. “It’s not that we believe we’re infallible. It’s that we’ve created structures making our fallibility irrelevant.”

THE TICKING CLOCK

Post-2008 reforms attempted bringing derivatives from shadows. Yet their fundamental nature remains unchanged. If anything, they’ve grown more essential to global economy functioning.

“The reforms were like installing better gauges on a nuclear reactor without addressing the chain reaction inside,” explains financial historian Dr. Sarah Levinson.

One dangerous assumption in derivatives modeling is that different markets maintain historical correlation patterns. Imagine ten tightrope walkers, each on their own rope, all connected by invisible strings. During normal times, if one wobbles left, another shifts right, maintaining balance.

But in crisis, these correlations break down—suddenly all walkers lurch in the same direction. The safety mechanism of diversity vanishes precisely when most needed.

Meanwhile, in research labs from Silicon Valley to Shanghai, AI systems now design derivatives that would have been unimaginable a decade ago.

“AI-powered derivatives are the new arms race,” explains analyst Richard Wong. “These systems identify patterns across thousands of variables simultaneously.”

The excitement stems from better risk management—neural networks spotting emerging correlations before humans. But the terror lies in their inscrutability. When AI designs derivatives, the reasoning often remains a “black box” even to creators.

THE SKEPTICS

Dr. Carolina Mendez, an economist who predicted aspects of 2008, argues derivatives represent inherent systemic risk that can never be fully regulated.

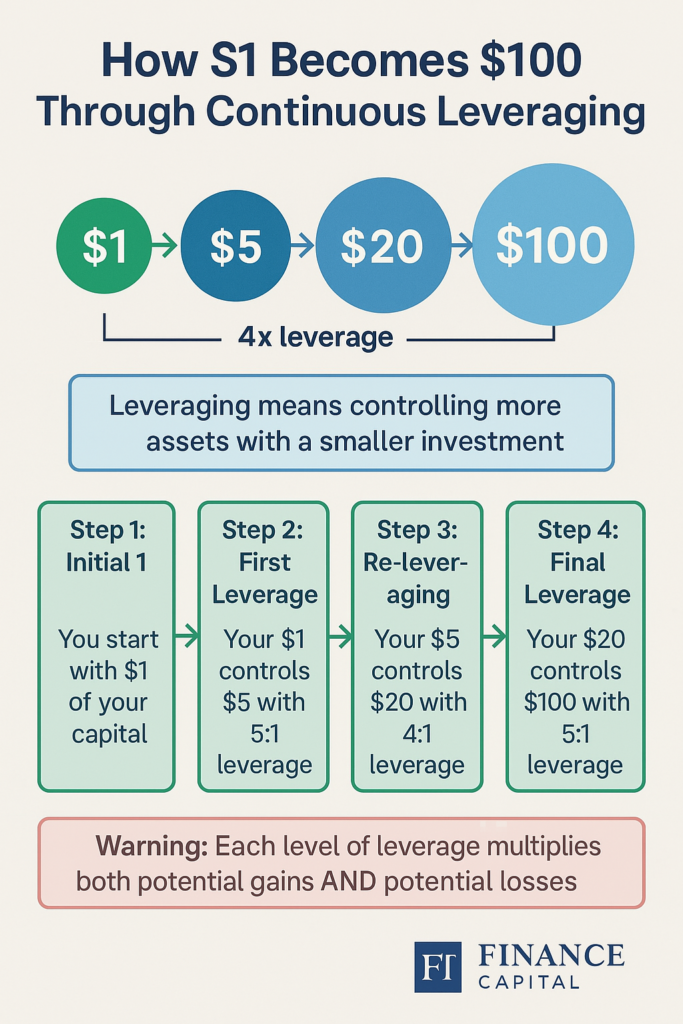

“The fundamental problem is leverage,” she explains from her Barcelona office. “Derivatives allow creation of virtually unlimited leverage without corresponding capital requirements.”

She points to a disturbing tendency: regulations create the illusion of safety, encouraging greater risk-taking in unregulated areas.

“Every time we build a fence, the market digs underneath it,” she says. “The complexity makes derivatives essentially ungovernable—there will always be innovations circumventing whatever guardrails we construct.”

WHEN THE MATH STOPS WORKING

[From the monologue of Dr. Eliza Montgomery, a fictional former hedge fund quantitative analyst now at a central bank systemic risk division]

I see it forming again. The patterns in data. Correlations shifting. Models straining at the boundaries of assumptions.

They call me paranoid. They don’t realize I designed some instruments they now trade without understanding. I built models they trust without questioning.

It starts with volatility compression—unusual market calm. Everyone mistakes quiet for safety rather than pressure building.

The credit default swap market flashes warnings. Correlation matrices between supposedly independent asset classes converge toward one—the mathematical signature of systemic failure approaching.

I ran scenarios through quantum computing simulation—a full Monte Carlo analysis with billion iterations. The distribution curve has a tail so fat it’s not a tail anymore; it’s a club.

When the math stops working, it won’t be gradual. Mathematics doesn’t negotiate. Models function perfectly until the moment they catastrophically don’t—like a bridge holding weight precisely until collapse.

I’ve warned about AI-designed derivatives—instruments so complex they’ve become their own form of emergent intelligence. We don’t control them anymore; we just provide the environment in which they evolve.

When this unravels—not if, when—it will make 2008 look like a market correction. The quadrillion-dollar shadow contains too much leverage, too many hidden correlations.

The clock isn’t just ticking. It’s accelerating.

CONCLUSION

The derivatives market stands as humanity’s most ambitious attempt to map uncertainty itself. While serving crucial economic functions—allowing farmers to lock in prices, businesses to manage currency risks—its expansion into a quadrillion-dollar behemoth raises profound questions.

The warnings are clear: complexity has outpaced understanding; leverage has multiplied beyond reasonable limits; models rely on assumptions that break precisely when most needed.

For citizens, the message is sobering: our financial system contains hidden vulnerabilities affecting everyone. For policymakers, the imperative is questioning whether regulation can ever contain the risks of unlimited leverage. For market participants, brilliant mathematics cannot eliminate risk—it can only transform and redistribute it, often visible only when too late.

As rain streaks down Manhattan windows, our trader executes another contract with a keystroke. Another strand in the web supporting the global economy. The system functions. The mathematics holds. The models predict within acceptable margins of error.

For now.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.